Processes

ESG Risk Assesment & Climate Change Classification (CC-C) as Part of Assesment of Customers/Loans Financing

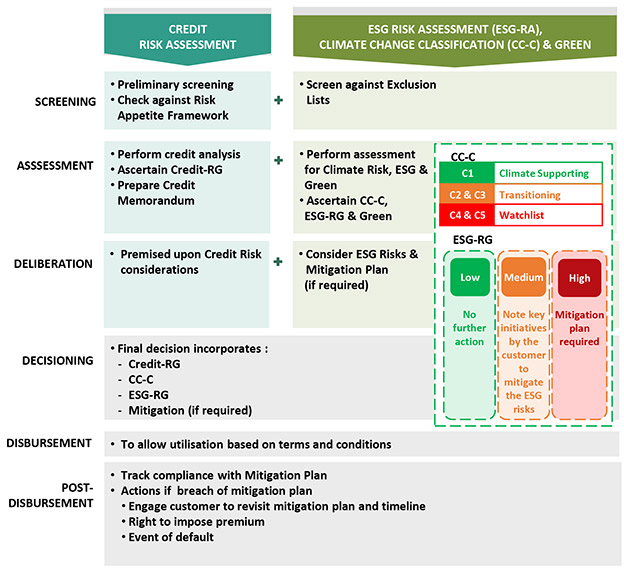

We assess environmental, social and governance risks of selected non-individual customers based on our Environmental, Social and Governance Risk Assessment (ESG-RA) and Climate Change Classification (CC-C) Guideline and Green Financing Guideline:

- for new applications

- for applications for additional facilities

- during annual reviews for existing customers

We assess the customer’s capacity, commitment and track record as part of our ESG-RA, such as:

- assessment on significant incident/ legal action/ penalty/ fine by authorities or third party in relation to ESG matters in the last one year

- availability of Sustainability Commitment, Sustainability Strategy, Risk Management Framework with ESG Integration?

Relationship managers and business units conduct the assessment using a checklist to generate the ESG–RG and CC-C. The ESG-RG outcomes influences the decisioning approval authority and depth of assessment.

For transactions rated high ESG-RG:

- Escalation to the Credit and Commitments Committee is mandatory

- Customers are required to develop a mitigation plan with time-bound monitoring triggers, where appropriate.

Client Monitoring and Engagement

The Bank will gradually enhance the process as we understand customers and the economy need time to transit. We are evaluating the appropriate manner for the inclusion of clauses related to environmental and social issues in loan/ financing documentations. For transactions rated high ESG-RG, customers are required to develop a mitigation plan with time-bound monitoring triggers, where appropriate. As a responsible financier, we will support clients who have committed to transition towards sustainable practices and to progress towards achieving meaningful decarbonisation in line with the goals of the Paris Agreement and/or Carbon Neutrality by 2050.

Customers are subjected to the annual review process. As part of the process:

- ESG-RG and CC-C will be reassessed

- Mitigation plans and timeline will be revisited for customers with deteriorated ESG-RG or breaches

- Customers with mitigation plans are tracked to ensure compliance

The Bank reserves the right to incentivise customer with improved ESG-RG or impose premium for those with deteriorated ESG-RG. In the event of non-compliance to agreed mitigation plans, the bank may consider to impose premium, increase security, tighten covenants, event of default or ultimately exit relationship.

In line with the Group’s Internal Policy Management Framework, our policies and guidelines will be reviewed every two (2) years or earlier if new legislation or circumstances render it appropriate.