Products

Targets to Support Sustainable Impact

- FY2020, Green loans/ financing to constitute 5% of net loans/ financing growth.

- FY2021, Green loans/ financing to constitute 10% of wholesale banking and business banking disbursement.

- FY2022, Internal targets set for loans/ financing disbursements with LOW ES-RG.

- FY2023, Internal targets set for loans/ financing disbursements with LOW ESG-RG,

C1-Climate Supporting classification and Green financing.

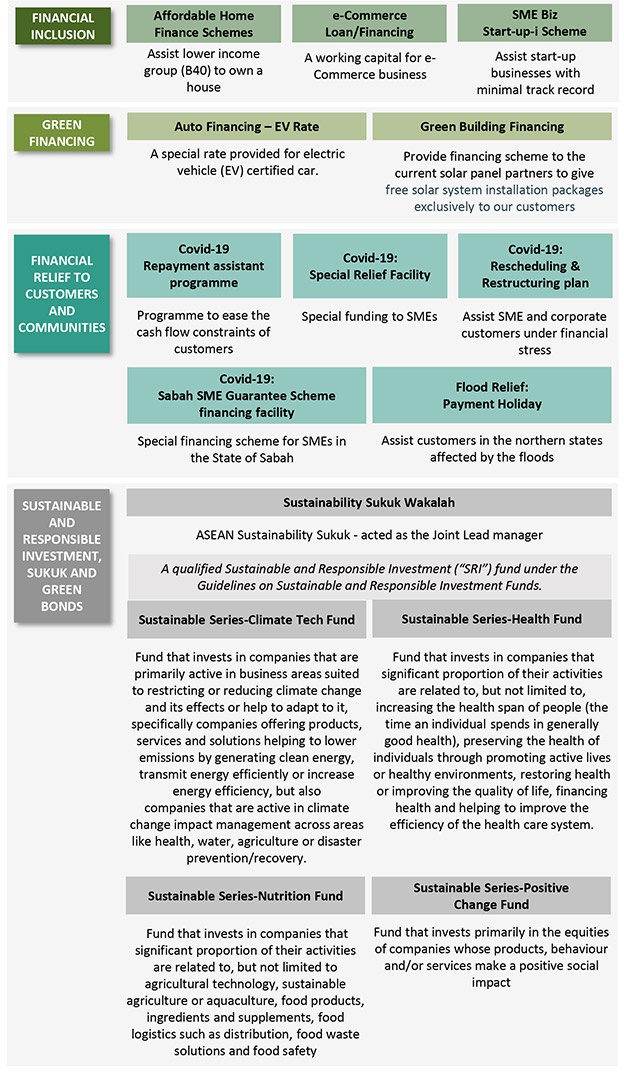

Sustainable-Oriented Products and Services

The targets were also driven by offering sustainable-oriented products and services:

Financial Inclusion

Financial inclusion is one of the key pillars of AmBank Group’s Sustainability agenda, where we provide access to financing to the underserved segments. This is manifested by inter alia a dedicated unit – Retail SME – to drive the penetration of micro finance.

- SME Biz Start Up Financing

A programme which offers start-up businesses financing between RM30,000 (USD6,600) to RM300,000 (USD66,000). RM44 million (USD9.6 million) of financing which have benefited 251 business start-ups have been disbursed.

- e-Commerce Financing

A programme which offers financing from as low as RM20,000 (USD4,400) to businesses which are involved in buying/selling of goods and services or the transfer of funds/data digitally. This is to support the emerging segment post COVID-19 pandemic. RM21 million (USD4.5 million) of financing which have benefited 61 business as of March 2022.

- iTEKAD

A social finance programme that offers financing to support the bottom 40% of eligible Malaysians (based on household income) with financing of up to RM20,000 (USD,4,400) per customer and capacity-building efforts of RM4,000 (USD856) per customer.

- Supporting micro-enterprises by leveraging Zakat (Islamic tithe) and partnering with Amanah Ikhtiar Malaysia (Malaysia’s micro-finance agency)

Entrepreneurial Stewardship: A total of RM283,000 (USD61,000) was distributed to 71 eligible petty traders to finance their businesses. They received assistance in the form of cash grants of up to RM5,000 (USD1,078) to purchase items/equipment for their businesses.

In addition, approximately 300 AIM members received cash assistance of up to RM300 per month for six months to support their daily expenses or business needs.

- Affordable Housing Affordable Housing

We support vulnerable communities to own affordable homes by participating in affordable home financing schemes such as Perumahan Rakyat 1Malaysia – Skim Pembayaran Fleksibel (PR1MA SPEF), Skim Rumah Pertamaku (SRP) and BNM Affordable Homes Schemes 1 and 2.

As at 31 March 2022, the total balance outstanding under the affordable home financing scheme was approximately RM200 million (USD40.4 million).

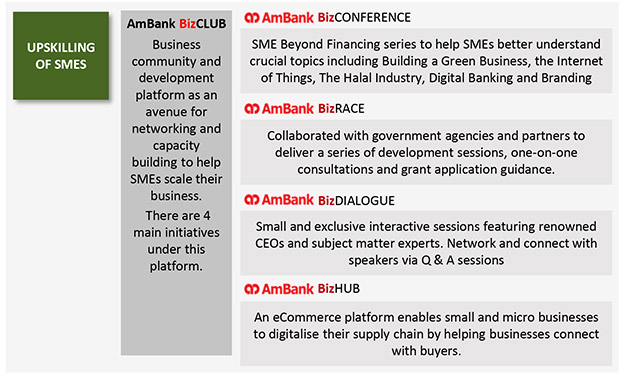

- SME Sector – Capacity Building / Upskilling

Our financial inclusion agenda goes beyond the provision of financing, whereby we also provide platforms for SMEs to build capacity.

- AmBank BizClub for SMEs and private small business owners to engage directly with top trainers and business leaders.

- Launched AmBank BizHub, an online marketplace for SMEs to support small and micro-businesses by providing an e-commerce platform that will help businesses connect to buyers.

- Supported continuous learning for SMEs through seminars, forums and events organised by BNM, AIBIM and SME Corp.

- Partnership with Capital Markets Malaysia (part of Securities Commission Malaysia) to provide online briefings on ESG to SMEs.

- The “Road to IPO/ Capital Markets” initiative to educate and guide our SME clients towards becoming a publicly listed company. They were given guidance surrounding the benefits of embarking on tapping the capital markets, the potential risks and upside to consider, and regulatory requirements.

Digital and technology initiatives

We are embracing digital technologies to reach out to our customers in expanding access to financial services. We have enhanced our digital presence to drive financial inclusion to meet the needs of customer segments particularly the SMEs.

- Digital On-boarding of Customers: AmBank is the 1st bank in Malaysia which allows for a fully end-to-end digital on-boarding of new SME customers.

- AMY

Malaysia’s first virtual assistant for customer service is a chatbot integrated into our mobile banking app that that offers seamless credit card services. We will expand to more credit card and non-credit card services and offer more language options.

- Mobile Application Terminal (MAT)

MAmBank is a pioneer in adoption of MAT, that facilitates off-site car financing application which can improve application turnaround time from 4 days to as fast as 1 day.

- Online Debt Consolidation Plan

First online banking solution that allows customers to aggregate card and non-card debts into a single debt or restructure the debt over a longer period to manage their financing payments.

- AmOnline Wealth

Allows customer to open a unit trust investment account and conduct investment transactions online.

- AmBank BizHub SME

A cloud-based platform with an integrated closed marketplace for small and micro businesses to digitalise their business, gain competitive advantage through an additional sales channel, increase productivity and efficiency as well as enable cost optimisation through improved visibility of their business spend – ultimately resulting in growth of revenue and profitability.

- AmAccess Biz

A banking on the go digital platform for SMEs businesses cash management solution e.g cross-border remittance and customised approval workflow.

Leveraging collaborative culture and partnerships

Developed strategic partnerships with cross-industry players to create holistic value propositions for customers targeting the underserved segments. These partnerships include:

- Partnership with Local Municipal Councils AmBank was able to reach-out to petty traders and offered collection solutions via mTAP (i.e. the petty trader can use a mobile device as a payment acceptance terminal to process debit and credit card transactions).

- Maxis (a mobile phone operator):

Utilised data-driven insights to provide tailored offerings for SMEs:

- SME-in-a-Box: bundled proposition with exclusive financial & digital solutions for SMEs. The partnership helped ease the SMEs’ business struggles resulting from COVID-19 impact, enabling business sustainability through digitalisation of their brick-and-mortar stores.

- K9 Android terminal: a modernised payment acceptance channel with connectivity by Maxis, backed by the Digital Payment Hub, to support SMEs to embrace cashless payment.

- BonusLink (consumer rewards program) its members, partner merchants, and employees. New feature introduced for customers to link their BonusLink and AmOnline accounts, enabling conversion of unutilised loyalty points to savings. This will enable us to deliver savings, financing, investment and protection offerings to BonusLink’s over 5.8 million active customer base.

- E-wallet Partnerhips

- Merchantrade Asia (digital money services business operator and e-money issuer) : A hybrid e-wallet venture as part of fintech-driven initiatives. Merchantrade's customers will be able to enjoy a much larger e-wallet capacity while reaping the benefits of their Current Account-i. This hybrid e-wallet is the first of its kind and with the largest wallet size of RM50,000

- Axiata Boost (digital financial services provider) – This collaboration enables digital solutions for retail merchants and underserved micro businesses (e.g. night market vendors, food and beverage outlets). Boost has been onboarded as Retail Payments Platform (RPP) Non-Bank Direct Participants (“NBP”) with PayNet, and AmBank is its RPP RENTAS Sponsor Settlement Bank.

- AmBank’s creative solution that enables local fintechs to offer 100% digital eKYC by riding on the Bank’s infrastructure. AmBank Islamic has introduced bespoke Application Programming Interfaces (API) powered by DuitNow of Paynets Network Malaysia Sdn Bhd (Paynet) to facilitate Rakuten Trade, the first full-fledged online equity broker in Malaysia’s online acquisition and on-boarding of new customers.

- Integration of AmOnline with Lembaga Tabung Haji (Malaysian hajj pilgrims fund board) where the new feature enables the linkage of Tabung Haji account with AmBank/AmBank Islamic account to experience seamless transactions.

Besides that, Amanah Saham Nasional Berhad (ASNB) (unit trust management company in Malaysia) is featured in AmOnline for the convenience of checking ASNB account balance as well as make additional unit trust investments

Outreach Events

ANNUAL ESG DAY

Held our inaugural virtual ESG Day, a platform to bring together perspectives and insights from customers and investors to help elevate the key themes in the transition to a more sustainable future. Themed ‘Forward Thinkers: Journeys That Converge’, the ESG Day also helped stakeholders understand our sustainability agenda by sharing our roadmap and progress.

AMBANK GROUP TO HOST A VIRTUAL WORKSHOP IN TRANSFORMING AND EMPOWERING SMES TOWARDS BECOMING SUSTAINABLE ENTREPRISES

Business Banking will be hosting a virtual development workshop in collaboration with Capital Markets Malaysia, aimed at guiding Small and Medium Entreprises (SMEs) through the induction of environmental, social and governance (ESG) principles and sustainability that can be part of their businesses. As ambassadors of AmBank Group, let's spread the word about this workshop to your SME clients and business partners. Customers can register at ambank.com.my/sustainablesme to join the session on 12 August 2022.

AMBANK GROUP’S SUSTAINABILITY ADVOCACY THROUGH KNOWLEDGE SHARING WITH MICPA MEMBERS

AmBank Group and the Malaysian Institute of Certified Public Accountant (MICPA) call upon professional accountants to uphold the responsibility in integrating sustainability in their organisation including green financing and financial inclusion.