AmBank supports SME business owners through strategic partnership with Persatuan Usahawan Maju Malaysia (PUMM)

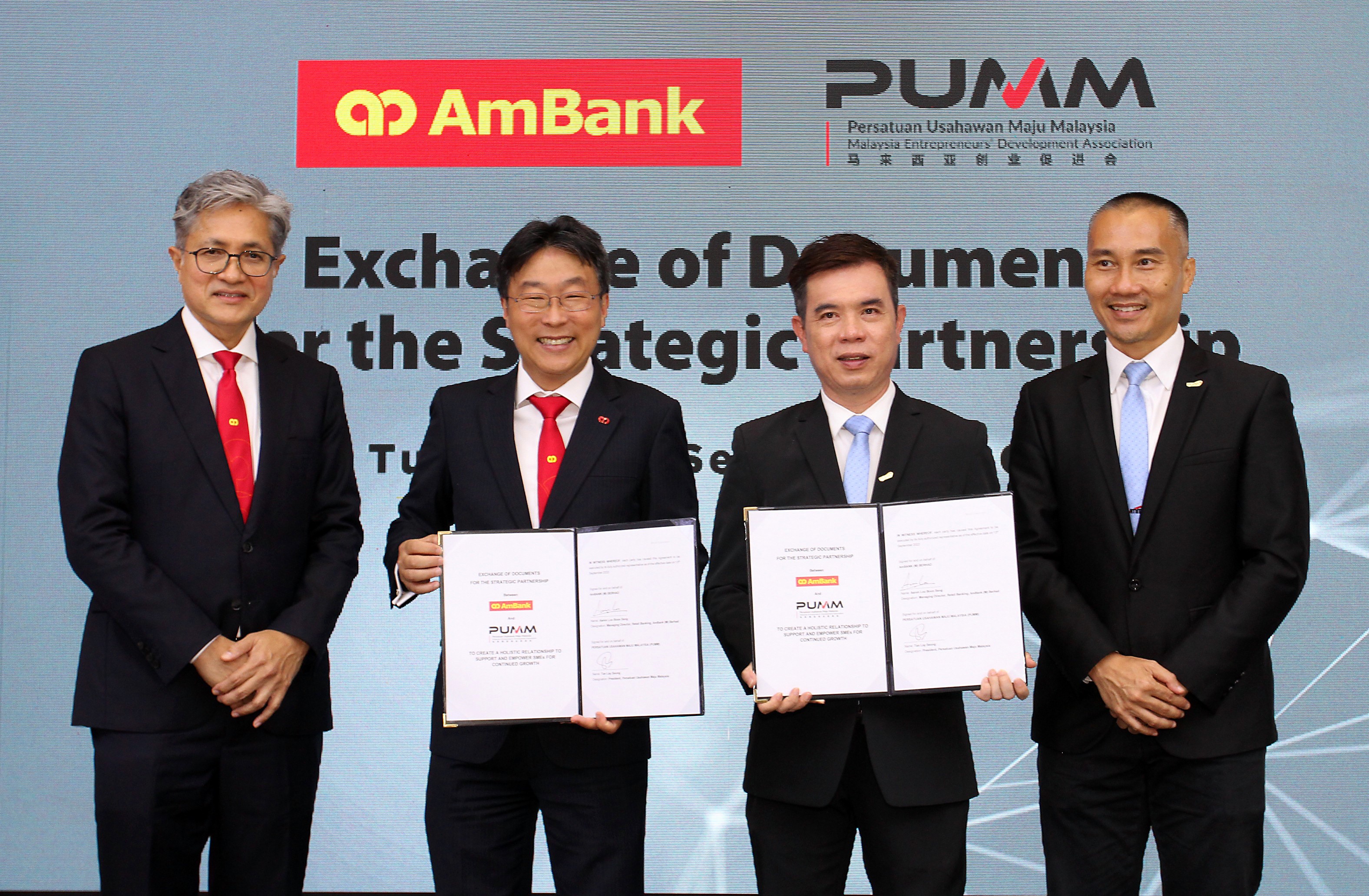

(From Left): Dato’ Sulaiman Mohd Tahir, Group Chief Executive Officer, AmBank Group, Aaron Loo, Managing Director, Retail Banking, AmBank (M) Berhad, Tan Lay Seong, National President, Persatuan Usahawan Maju Malaysia (PUMM) and Nelson Beh, National Deputy President, Persatuan Usahawan Maju Malaysia (PUMM).

The partnership is in recognition of SME’s pivotal role in driving Malaysia’s economic recovery and future growth

Thursday, 15 September 2022 - AmBank has entered into a two-year strategic partnership with Persatuan Usahawan Maju Malaysian (PUMM) which will pave the way for AmBank to work with PUMM members in order to strengthen their financial awareness and enabling them to more easily gain access to financing in addition to providing an understanding of the various products and tools that AmBank has to help businesses optimize. The non-profit organization has over 3,000 business owners from diverse business sectors including construction, information technology, logistics, F&B, and advertising.

The partnership is positioned as an empowerment package by AmBank to PUMM members, leveraging on PUMM’s platform to get connected with their members and their other business partners to drive new-to-bank (NTB) acquisition over the two-years partnership term.

It is also testament of AmBank’s continuous efforts to go beyond financing in supporting SMEs growth by creating holistic relationships which include providing strategic solutions that meets the need of SMEs and further help them operate efficiently and seamlessly.

Dato’ Sulaiman Mohd Tahir, Group Chief Executive Officer, AmBank Group said “At AmBank, we are constantly thinking out of the box by introducing a range of initiatives and partnerships in our resolute mission to empower and rejuvenate SMEs. It is part of our development initiatives that help SMEs reset, revive and grow especially during these unprecedented times where businesses are still recovering from the effects of the pandemic. This partnership with PUMM is well aligned with our SME growth and empowerment agenda, and we certainly look forward to fostering new and meaningful bank-client relationships driven by this collaboration.”

Aaron Loo, Managing Director, Retail Banking, AmBank said “A major challenge many SMEs face today is gaining access to financing. In many cases, the business they are in would have qualified, however, they were unable to obtain approvals due to unfamiliarity with the criteria as well as processes. I am thrilled that AmBank is partnering with PUMM as it would enable us to work with their members to educate them on the best approach to successfully gain financing. In addition, we will also be able to share with them other products and services that would help optimize their businesses including our award winner digital bank, AmAccessBiz, as well as foreign currency products that help exporters and importers manage their currency risks.”

Due to their significance to the economy, the Malaysian government has continuously devoted a large share of its fiscal expenditure to the further development of SMEs.

“SMEs are the backbone of Malaysia’s economy with over 68.1% of SMEs being direct suppliers of large foreign firms in Malaysia. In view of their importance to the economy, AmBank has been stepping up its assistance to this segment by providing best in class services through its SME-in-a Box programme which provides a broad range of products from financing, protection, deposits, transactions, foreign exchange in addition to assisting clients to digitize their business,” he said.

Mr. Tan Lay Seong, the national president of PUMM, pointed out that “The association is very much priviledged to be in collaboration with AmBank Group as this will create a long-term financing solution for the members.

“As the economy scales towards recovery from the pandemic, this collaboration is incredibly timely as our members expect financial assistance hence this collaboration will provide them with adequate financial sustainability solutions for their businesses. Many SMEs owned by PUMM members are looking for cross-border opportunities and AmBank Group is well-placed to help our association in expanding their reach and realise their growth ambitions”, says Mr. Tan.

Beyond financing solution, AmBank Group will also benefit as PUMM members go through growth and expansion of their respective businesses.

Mr. Tan also added that the collaboration between PUMM and AmBank Group will be a historic moment in strengthening business connections and opening markets between different business enterprises within various industries such as telecommunications, developers, hospitals, and many others.

AmBank will also leverage on PUMM’s platform to get connected with their members and their other business partners to drive new-to-bank acquisition during the course of the partnership. In tandem to the newly launched AmBank Visa Business Card recently, the members of PUMM will be offered a one-off special cashback on top the benefits obtained from the ordinary value propositions. The newly launched AmBank Visa Platinum and Infinite Business Card gives top-notch value propositions such as high cashback earnings, dining and accommodation privileges, and complimentary travel insurance coverage for Small Medium Industry to Large Corporation.