| Year | Details |

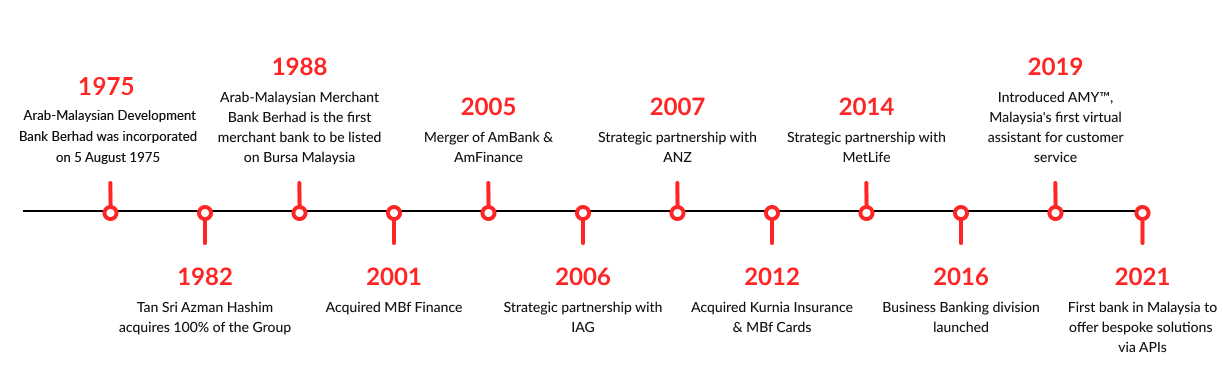

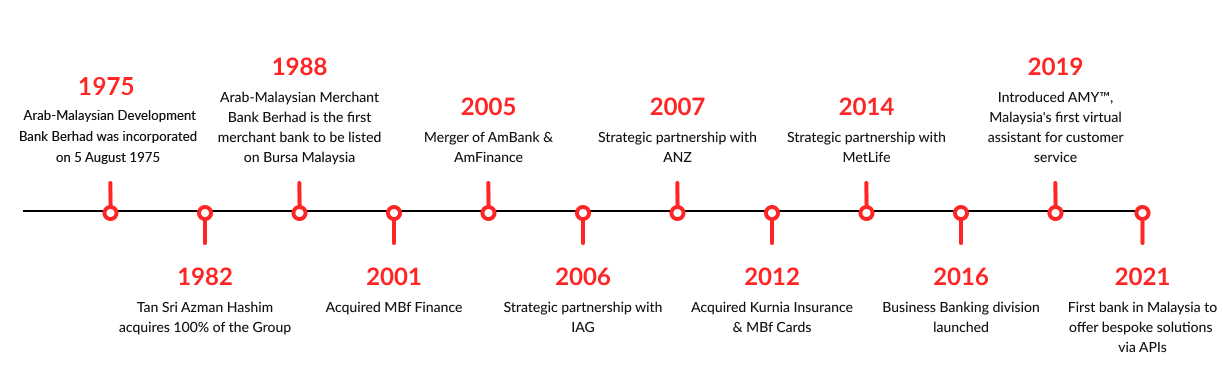

| 1975 | - Arab-Malaysian Development Bank Berhad was incorporated on 5 August 1975 as a joint venture between Malaysian Industrial Development Finance Berhad with a 55.0% shareholding, Arab Investments for Asia (Kuwait) with a 33.0% shareholding, and the National Commercial Bank (Saudi Arabia) holding 12.0%

|

| 1977 | - The Group acquired a 70.0% shareholding in Malaysian Industrial Finance Company Limited, which was later renamed Arab-Malaysian Finance Berhad (AMFB)

|

| 1980 | - AMFB became the first private sector institution in Malaysia to issue public bonds – RM20.0 million 8.5% Guaranteed Bonds 1987, listed on the Kuala Lumpur Stock Exchange. The Bonds marked a new chapter in the history of private sector fund raising in the capital markets

|

| 1982 | - Tan Sri Azman Hashim acquired 100.0% shareholding in the Group

- The Group acquired the remaining 30.0% shareholding of AMFB, making it a wholly-owned finance company subsidiary

|

| 1983 | - The Group was renamed Arab-Malaysian Merchant Bank Berhad (AMMB)

- AMMB established a credit and leasing company, Arab-Malaysian Credit Berhad

|

| 1984 | - AMMB launched Malaysian Ventures Berhad to undertake private equity investments

- AMMB arranged the first leveraged lease facility in the country for Sistem Televisyen Malaysia Berhad (TV3)

- AMMB acquired Arab-Malaysian Insurance Berhad, a general insurance company formerly known as Teguh Insurance Company Sdn Bhd

|

| 1985 | - AMMB acquired Perima Assurance Berhad, a life insurance company

|

| 1986 | - AMMB acquired a stockbroking firm, Kris Securities Sdn Bhd, later renamed as AmSecurities Sdn Bhd

- AMMB relocated its corporate headquarters to Jalan Raja Chulan, Kuala Lumpur

- Antah Holdings Berhad and Tokai Bank Limited, Japan acquired 20.0% shareholding each in AMMB

- AMMB launched Arab-Malaysian Unit Trusts Berhad to manage unit trust funds

|

| 1987 | - AMMB's two insurance companies merged to form Arab-Malaysian Eagle Assurance Berhad, holding composite insurance licenses

- AMMB sponsored the establishment of The Malaysia Fund Inc, a close-ended investment fund listed on the New York Stock Exchange, to invest in equities of Malaysian companies listed on the KLSE. The Malaysia Fund raised USD87.0 million

|

| 1988 | - AMMB became the first merchant bank to be listed on the Kuala Lumpur Stock Exchange

- AMMB was appointed as Adviser to the Government to formulate the National Privatisation Masterplan

- AMMB launched the first equity unit trust fund, Arab-Malaysian First Fund

|

| 1989 | - Arab-Malaysian Property Trust became the first property trust to be listed on the KLSE

|

| 1990 | - AMMB was appointed as Adviser and Managing Underwriter for the flotation of Telekom Malaysia Berhad

- AMFB acquired First Malaysia Finance Berhad

|

| 1991 | - AMMB acquired a 49.0% equity stake in the holding company of Fraser Securities, Singapore

- AMMB, in collaboration with The Nikko Securities Co. Ltd. in Japan, sponsored the establishment of Malaysia Fund (Labuan), the first offshore unit trust fund in the Federal Territory of Labuan

- Pursuant to a corporate restructuring scheme, AMMB Holdings Berhad became the holding company of the Arab-Malaysian Banking Group and assumed the listing status of AMMB

- Arab-Malaysian Finance Berhad, the Group’s finance company, was listed on the KLSE

|

| 1993 | - AMMB launched Tabung Ittikal Arab-Malaysian, the first Islamic Unit Trust Fund

- AMMB acted as Manager and Arranger for the RM240.0 million Syndicated Credit Facility for the construction of Menara Kuala Lumpur

|

| 1994 | - AMMB ventured into commercial banking with the acquisition of the Malaysian operations of Security Pacific Asian Bank Limited from Bank of America (Asia) Limited. It started commercial banking operations as Arab-Malaysian Bank Berhad

|

| 1995 | - AMMB International (L) Ltd commenced offshore banking operations in Labuan, the first merchant bank to offer offshore banking services

- AMMB Futures Sdn Bhd commenced futures broking business

|

| 1996 | - AMMB Holdings Berhad’s annual report won the Overall Award for the Most Outstanding Annual Report for six consecutive years from 1991 to 1996 in the NACRA awards

- Macquarie Bank Limited, Australia acquired 30.0% shareholding in each of AMMB Futures Sdn Bhd, AMMB Asset Management Sdn Bhd and Arab-Malaysian Unit Trusts Berhad

|

| 1997 | - AMMB Securities (HK) Limited commenced stock broking operations in Hong Kong

|

| 1998 | - AMFB acquired the assets and liabilities of Abrar Finance Berhad, in line with the Government’s plan to consolidate the industry

|

| 2001 | - AMFB acquired MBf Finance Berhad

|

| 2002 | - Merger of Arab-Malaysian Finance Berhad and MBf Finance Berhad, following the vesting of the assets and liabilities of AMFB into MBf Finance Berhad. The latter changed its name to AmFinance Berhad. AMFB was converted into AMFB Holdings Berhad

- 'Arab-Malaysian Banking Group' rebranded to 'AmBank Group' with new Group corporate colours of red, representing prosperity and good fortune and yellow representing commitment and unity

|

| 2003 | - Bangunan AmFinance, now known as Menara AmBank on Jalan Yap Kwan Seng, Kuala Lumpur, was officially opened by the then Prime Minister, Tun Dr Mahathir Mohamad

|

| 2005 | - Completed privatisation of AMFB Holdings Berhad

- AmInvestment Group Berhad, the Group’s investment banking operations, listed on Bursa Malaysia

- AmBank and AmFinance merge to create AmBank (M) Berhad, the sixth largest domestic bank in the country.

|

| 2006 | - Am Private Equity, a private equity fund, was launched

- Insurance Australia Group Limited, Australia acquired 30.0% shareholding in AmAssurance Berhad

- Am ARA REIT Managers Sdn Bhd was incorporated with AIGB holding 70.0% equity and ARA Asset Management (Malaysia) Limited 30.0%, to manage the AmFIRST REIT listing on Bursa Malaysia

- AmIslamic Bank commenced operations, with the vesting of the Islamic assets and liabilities of AmBank (M) Berhad into a separate subsidiary company

|

| 2007 | - AmBank Group completed the integration of AmSecurities Sdn Bhd into AmInvestment Bank, which began operating as a full-fledged investment bank offering both merchant banking and stockbroking services

- AmBank Group marks the entry of Australia and New Zealand Banking Group Limited (“ANZ”) as its strategic partner and major investor

|

| 2008 | - Completed privatisation of AIGB, which became a wholly owned subsidiary of AMMB

- Establishment of AmG Insurance Berhad to facilitate the separation of the composite insurance business of AmAssurance Berhad into general insurance and life insurance businesses

- Friends Provident PLC acquired 30% stake in AmLife Insurance Berhad

- AmBank and ANZ entered into a technical services agreement to establish AmBank Group's foreign exchange, interest rate and commodities deriviatives business

- IAG increased its stakeholding in AmG Insurance Berhad to 49.0% from 30.0%.

|

| 2009 | - AmIslamic Funds Management Sdn Bhd obtained a licence for Islamic funds management of offshore and domestic Islamic financial instruments for institutional and retail investors

- AmCapital (B) Sdn Bhd opened, bringing expertise in funds management, Islamic finance and investment advisory to Brunei Darussalam

- ANZ increased its shareholding in AmBank Group to 23.91% by converting its exchangeable bonds into new ordinary shares

- AmBank-MyKasih Community Programme was launched

|

| 2010 | - AmBank (M) Berhad successfully issued RM1.42 billion senior notes under its newly established 30-year RM7.0 billion Senior Notes Issuance Programme, being the first financial institution to issue senior notes in Malaysia

- AmIslamic Bank successfully issued RM550.0 million Senior Sukuk under its newly established 30-year RM3.0 billion Senior Sukuk Musyarakah Programme

|

| 2011 | - The Group continued to be recognised as an industry leader with awards including: Best Domestic Bond House in Malaysia from The Asset Triple A Country Awards 2010, Best Bond Group at The Edge-Lipper Malaysia Fund Awards, Five awards at the RAM League Awards 2011 for excellence in the bond markets, Best Chief Financial Officer for Investor Relations – Large Cap award at the MIRA Inaugural Malaysia Investor Relations Award, Best of Asia Award at the Corporate Governance Asia Recognition Awards 2011

|

| 2012 | - AmBank Group and ANZ signed the Business Principles Agreement to collaborate in areas of banking businesses including Islamic banking, transaction banking and wealth management across 27 countries, including Australia, China, Indonesia, Singapore and Vietnam

- AmSignature Priority Banking is launched, delivering personalised banking to the affluent segment in Malaysia

- AmFamily Takaful Berhad commenced Family Takaful business

- The Group’s new corporate social responsibility platform AmKasih was launched

- AMMB Holdings Berhad changed its stock short name to AMBANK

- AmBank Group completed acquisition of Kurnia Insurans (Malaysia) Berhad, emerging as Malaysia’s No. 1 motor insurer

- AmBank Group completed acquisition of MBF Cards (M’sia) Sdn Bhd

|

| 2013 | - Maiden issuance of Exchange Traded Bonds and Sukuk 'ETBS' on Bursa Malaysia by DanaInfra Nasional Berhad, creating new asset class on the Exchange, with AmInvestment Bank as one of the Lead Arrangers

- AmBank Group clinched the prestigious Bank of the Year in Malaysia 2013 award (The Banker Magazine) in recognition of the Group’s strong management, sound business model and prudent risk management

- AmBanCS, the Group’s new core banking system went live

|

| 2014 | - AMMB Holdings Berhad’s wholly-owned subsidiary, AMAB Holdings Sdn Bhd, and MetLife Inc.’s subsidiary, MetLife International Holdings, Inc., entered into a share sale agreement which involved the sale of equity interest of AmLife Insurance Bhd and AmFamily Takaful Berhad. The signing was witnessed by Datuk Seri Najib Tun Razak, Prime Minister of Malaysia and Barack Obama, President of the United States of America

- AmBank Group unveiled the brand new logos of AmMetLife and AmMetLife Takaful, reflecting the new strategic partnership between AmBank Group and MetLife Inc

|

| 2015 | - The 'AmIslamic Bank' brand was rebranded to 'AmBank Islamic'. The legal entity name was also changed from AmIslamic Bank Berhad to AmBank Islamic Berhad

- AmFIRST REIT announced the Proposed Acquisition of a three-storey MYDIN Hypermall in Pulau Pinang on 15 April 2015 for a total cash consideration of RM250 million

|

| 2016 | - AmMetlife Insurance and AmMetlife Takaful moved their head office to Menara 1Sentrum

- AmBank Group launched its Top Four strategy to be one of Malaysia's leading banking groups by 2020

|

| 2017 | - Launch of Business Banking division to focus on Enterprise Banking and Commercial Banking.

- Launch of Mobile Application Terminal (MAT), the first instant approval service for the Malaysian automotive market.

|

| 2018 | - Introduction by AmGeneral Insurance of the first full accident coverage.

|

| 2019 | - Introduction of AMYTM, the country’s first virtual assistant for customer service.

|

| 2020 | - Pioneering business-to-business (B2B) Application Programming Interface (API) services via real-time retail payments (RPP) DuitNow.

|

| 2021 | - Became the first bank in Malaysia to offer bespoke solutions via APIs, enabling Fintech partners to fully digitalise their onboarding journey.

|