Sustainability at AmBank

Sustainability is integral to how we win together with our stakeholders. We embed sustainability principles across our operations to drive responsible growth, financial resilience, and inclusive impact. Guided by our Winning Together 2029 (WT29) strategy, we focus on delivering measurable outcomes through responsible banking, conscious self-conduct and positive societal impact, while supporting Malaysia’s broader transition to a low-carbon and equitable economy.

Sustainability is about empowering communities, future-proofing businesses, and contributing to national priorities such as financial inclusion and climate resilience. To stay responsive and focused, we anchor our sustainability journey on what matters most to our stakeholders. This drives how we allocate resources, manage risks, and deliver value across our ecosystem.

“ We view sustainability as our legitimacy to operate, embedding it into every part of our growth and operations, advancing responsible finance and climate resilience. ”

Jamie Ling

Group Chief Executive Officer

AmBank Group

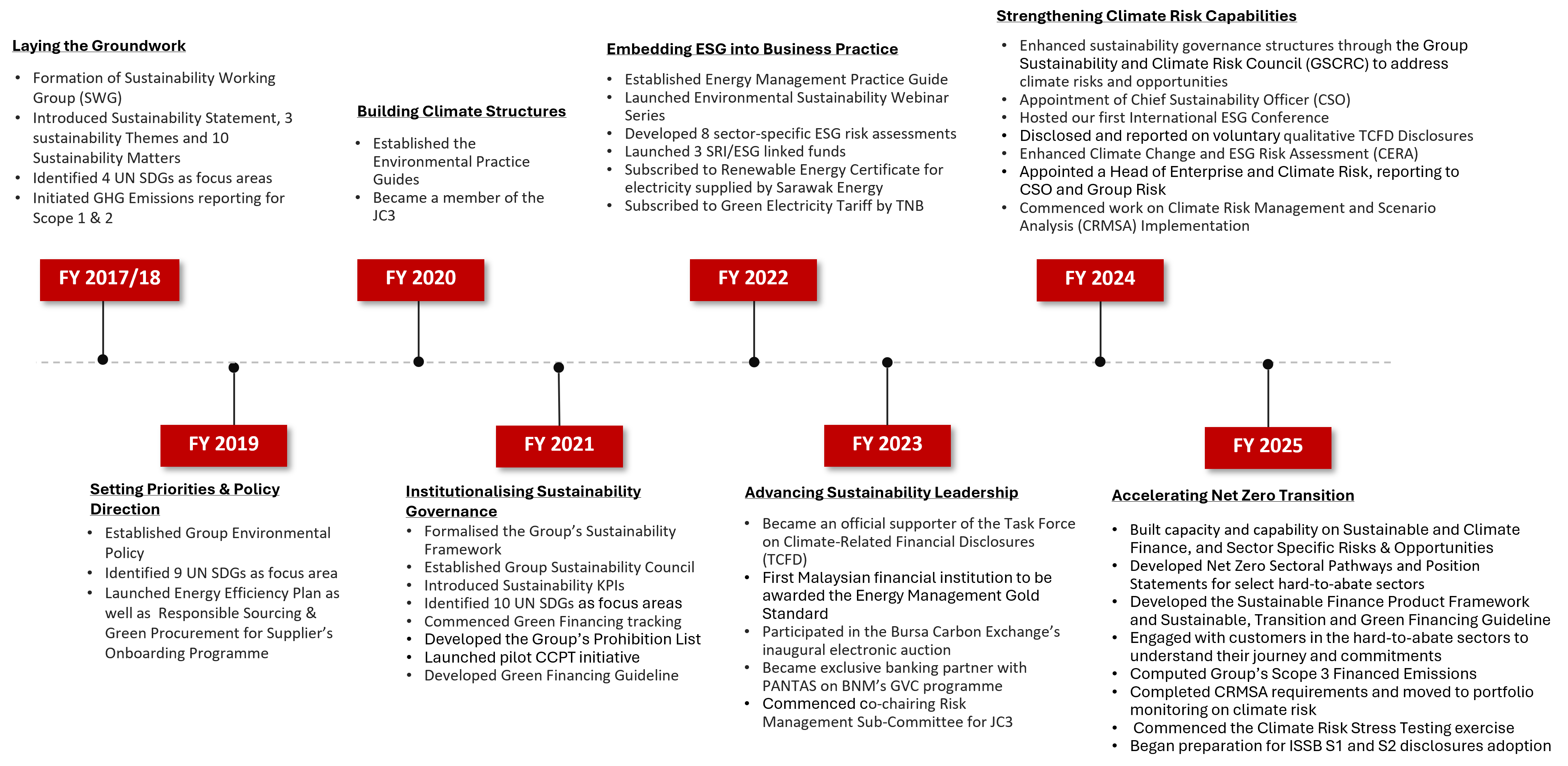

Our Sustainability Journey

Our Progress and Achievements in FY2025

Net Zero Transition Plan

Achieving Net Zero by 2050 is a strategic priority for AmBank Group. This is central to our commitment to Shaping Tomorrow Together through the development of our inaugural Net Zero Transition Plan (NZTP), with Near-term 2030 Targets and Position Statements established for select hard-to-abate sectors. Our NZTP has been developed for the agriculture, energy and built environment economic focus areas. We are committing to phase out thermal coal mining by 2030.

We aim to be a responsible financial institution by adopting a pragmatic approach considering the Malaysian economy and operating landscape, and ensuring credibility is maintained through relevant science-based pathways.

Our Position Statements define the Group’s strategic stance for customers operating in the select hard-to-abate sectors, signalling our expectations on how we will continue to support our customers, through sustainable, transition and green financing. These Position Statements reflect the Group’s proactive approach to engaging with customers, ensuring continuous improvement in their environmental and social risk management practices.

For the sectoral pathways and position statements for each sector, click on the below:

Sustainable Finance Product (SFP) Framework

The SFP Framework serves as a guiding tool for integrating sustainability elements into the Group’s product development across all banking segments, including conventional and Islamic financial products and services.

The SFP Framework which is anchored on industry best practices, guidelines and principles established by credible authorities and certified bodies, is aligned with local, regional, and global sustainability standards.

Our Solutions

Awards and Recognitions

Recognitions |

|