Portfolio

ESG Risk Assessment and Mitigation on our Portfolio

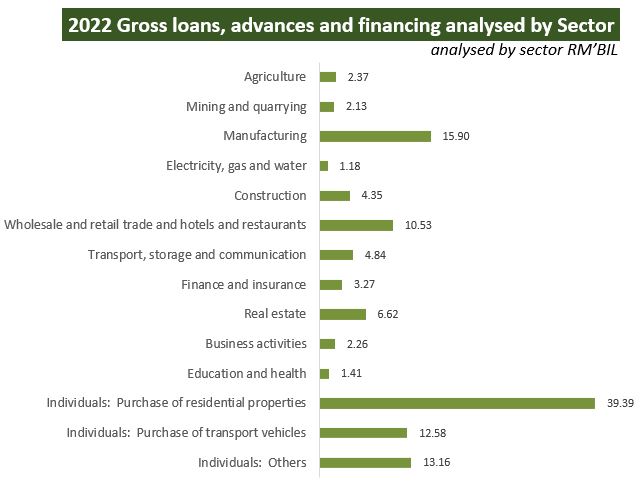

On an annual basis, we review our portfolio exposure as guided by our AmBank Group Risk Appetite Framework. In addition, we review the annual loan/ financing disbursements vis-à-vis the Environmental, Social and Governance Risk-Grade (ESG-RG).

We are evaluating on incorporating climate change considerations into stress testing and scenario analysis for our portfolio.

As part of the implementation of the BNM Climate Change Principle-Based Taxonomy (CCPT), our strategies to manage and mitigate climate-related risks across our portfolio may include:

- Set overall targets for climate supporting portfolio exposure

- Control disbursements to customers that do not take any initiative to transit to more sustainable practices

- Adopt a nurturing approach to support customers to transit towards more sustainable practices such as favourable loan/ financing terms and capacity building programmes

Target to Reduce Negative Impact Beyond own Activities

The bank has set a target to achieve 70% of loans /financing portfolio to constitute low ESG-RG by 2030 and will set yearly ESG-related disbursement targets to achieve the 2030 target. These to support Malaysia’s aspiration to become carbon neutral by 2050.

Science Based Targets

We are in the midst of evaluating the appropriate science-based targets and climate change disclosures, including based on Science Based Targets initiative and Task Force on Climate-Related Financial Disclosures (TCFD) recommendations.

Independent Assurance

The veracity of selected areas in AmBank Group Sustainability Statement were verified by an external auditor, SIRIM QAS International. More information, please refer to our latest Sustainability Annual Report.

Disclosure of Positive and Negative Impacts Associated with Business Activities Beyond Direct Impacts from own Operations

As a financial institution, our products and services fuel personal consumption, business activities and economic growth. We currently overlay sustainability practices with our business conduct to minimise the negative impact of our business by assigning ESG-RG as part of our credit process.

We are striving to mitigate the indirect negative impacts from our business activities such as our indirect GHG emissions by installing solar panels on selected premises or using hybrid/electric vehicles.

Source: AMMB Holdings Berhad Annual Financial Report 2022