People

Sustainability Governance and Responsibility

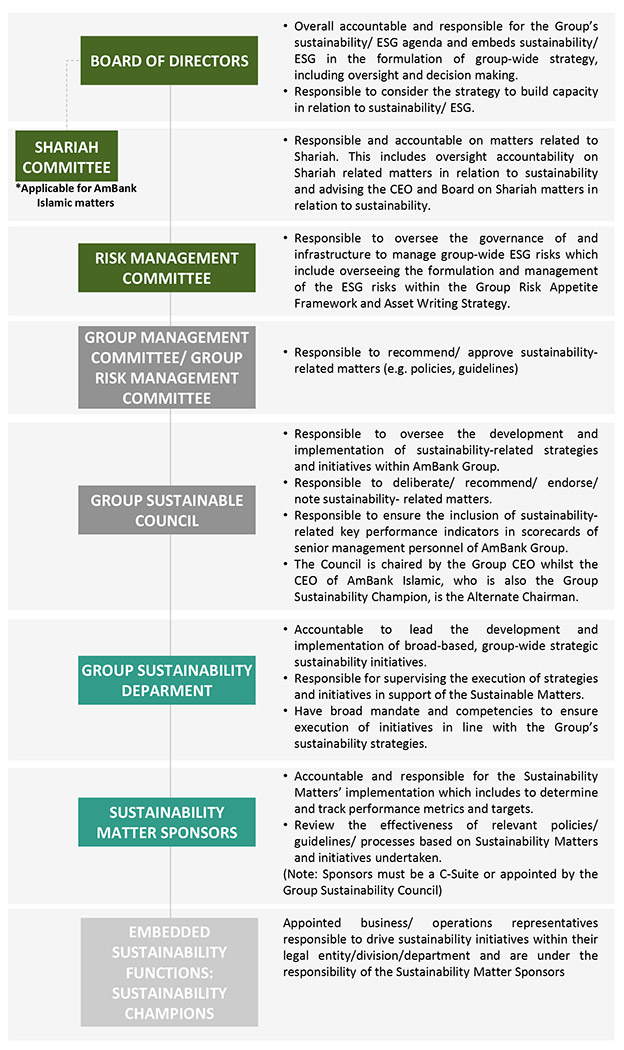

Our sustainability governance structure ensures strong oversight and execution of sustainability-related strategies. Across the Group, we have clear functions in place, with specific roles and responsibilities to efficiently address our ESG risks and opportunities.

Our governance structure includes

- Senior management responsibilities for the implementation of the bank’s ESG strategy

- Senior management's responsibilities for the management of climate change risks and opportunities relevant to the bank's activities

- Roles and responsibilities of the various departments, committees or teams involved in developing and implementing

- The details are articulated below

The details are articulated below

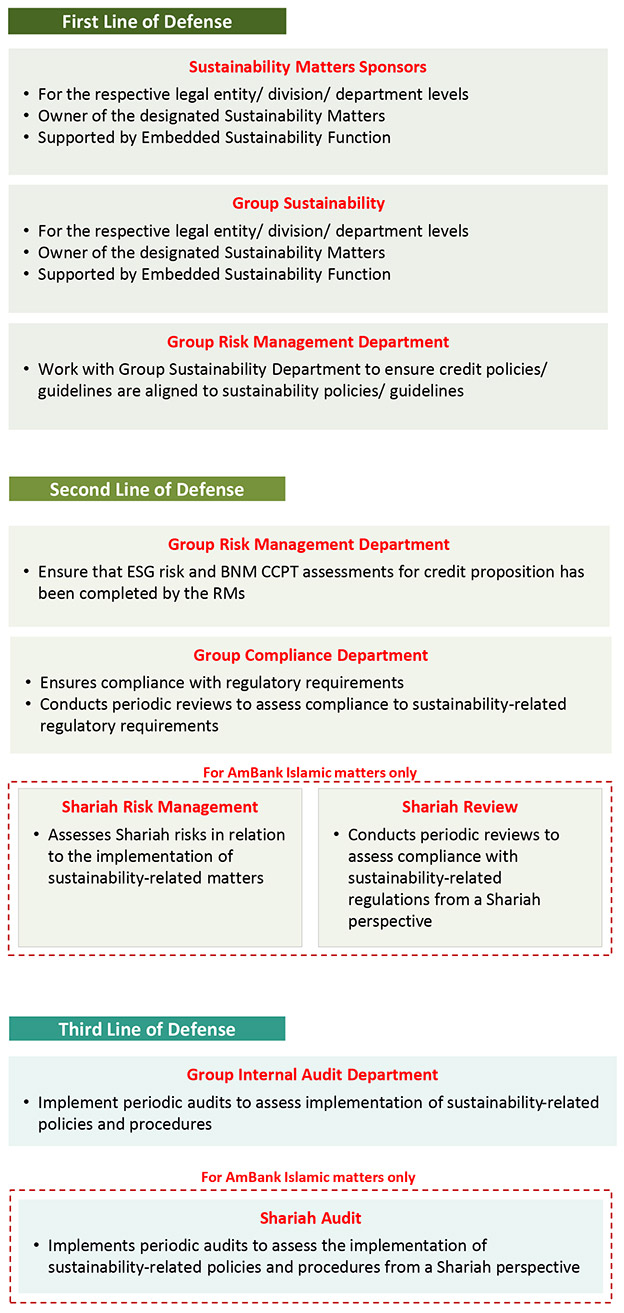

Internal Controls

We have identified the relevant departments within each line of defence which are responsible to put in place the internal controls in relation to ESG risks

Audit

The auditing aspects of the sustainability related policies and procedures would be under the purview of the Group Internal Audit Department. The last audit was conducted in 2021.

Implementation of Sustainability-related Policies and Procedures

The Group Sustainability Department will oversee the implementation of Sustainability related policies and procedures. Sustainability Sponsors will review the effectiveness of relevant policies, guidelines and processes based on Sustainability Matters and the implemented initiatives.

Training

Sustainability capability building and awareness across all levels is key to ensure the success of the Group Sustainability Agenda.

People Development

We continue to create and support career opportunities for all our people through relevant and targeted personal development initiatives.

Certifications:

- Asian Institute of Chartered Bankers (AICB) Certification: More than 800 employees have completed various AICB certification which includes AML/ CFT, Audit, Compliance, Risk Management and Credit.

- Chartered Professionals in Islamic Finance - Industry-recognised professional qualification for developing leaders in the Islamic Finance.

- Association of Shariah Advisors in Islamic Finance (ASAS): AmBank enrolled its Shariah Committee members to undertake Certified Shariah Advisors (CSA) under the ASAS.

Graduate Programmes

- AmGraduate Programme, an intensive 18-month programme that develops young Malaysian graduates to be leaders of tomorrow with AmBank Group. The programme accelerates the young talent’s learning curve and enables them to shape their career in the financial services sector.

- AmDigital Graduates Programme, a one-year graduate programme that aims at attracting, develop and retain top digital talent to drive digital innovation and transformation for the organisation.

- Protégé Programme, hired fresh graduates under the AmBank’s Protégé Programme in support of Government’s initiative to encourage the employability of the young graduates in Malaysia

Leadership and Talent Development Programme:

- AmDiscovery Programme, a speed mentoring programme from talent to talent with active collaboration with leaders across the organisation. The programme helps accelerate the personal and professional development of employees while providing networking opportunities

- Talent development programmes

- Talent Manager for Assistant Managers and Managers (BATMAN)

- Emerging Leaders Programme for Senior Managers and Vice Presidents (ELP)

- Leadership Enhancement and Acceleration Programme for Senior Vice Presidents and Executive Vice Presidents (LEAP)

- Digital Academy Management Council to drive digital-related skills, certification and awareness.

Partners with external stakeholders to deliver joint training programs for staff

We provide our employees with relevant trainings to ensure that they have the skills needed. We have engaged with external provider to deliver some these trainings for our employees in certain skills.

- ESG Training

We engaged an external training provider to provide comprehensive ESG training for:

- Board of Directors

- Senior Management

- Risk Managers

- Employees at all levels

- ISO 14001 Training & Environmental webinar

Engaged with SIRIM to train our staff on the ISO 14001. Addition to that, we engaged with various environmental organisation including government agency to provide webinar for employees e.g. Basic Carbon Calculation by Climate Action Group, MGTC and Great Minds Recycle eWaste by Department of Environment and Water.

- Compliance Training

Engaged with Institute of Internal Audit Malaysia, Malaysia Institute of Accountant MIBA, SIDC, Association of Certified Anti Money Laundering Specialist to organise:

- 62 compliance training and awareness sessions for personnel via annual and periodic e-learning e.g. AMLA, KYC, Phising Awareness, Essential Operating Risk Management

- Online training on specific compliance-related topics by internal subject matter experts and some external consultants, Compliance Culture initiatives, and email communications with embedded links to relevant policies and guidance

Managerial/ Leadership Development Training with external parties such as Leadership Resources, Leaderonomics, Maslow, PBT Consultant, DDI, Asian Banking School, The Ville Sdn Bhd

- OSH Training

We engaged experts to provide OSH training e.g. Incident Investigation & Reporting; Essential First Aid, CPR & AED Virtual Training (2 sessions); Essential First Aid, CPR & AED Virtual Training (2 sessions); Defensive Riding

- EQ Training

Trained our front-line staff on specially crafted emotional intelligence (EQ) training to provide emphatic services to customers who may be facing pandemic-related stress.

Key Performance Indicators (KPIs)

The Group Sustainability Framework requires sustainability key performance indicators (KPIs) be set across the organisation with sustainability-related criteria and will be embedded in the scorecards for performance assessment across the Group. As of now, sustainability KPIs have been embedded into the scorecards of the Group CEO, C-Suites, Sustainability Champions and other relevant staff.