Net Zero Transition Plan

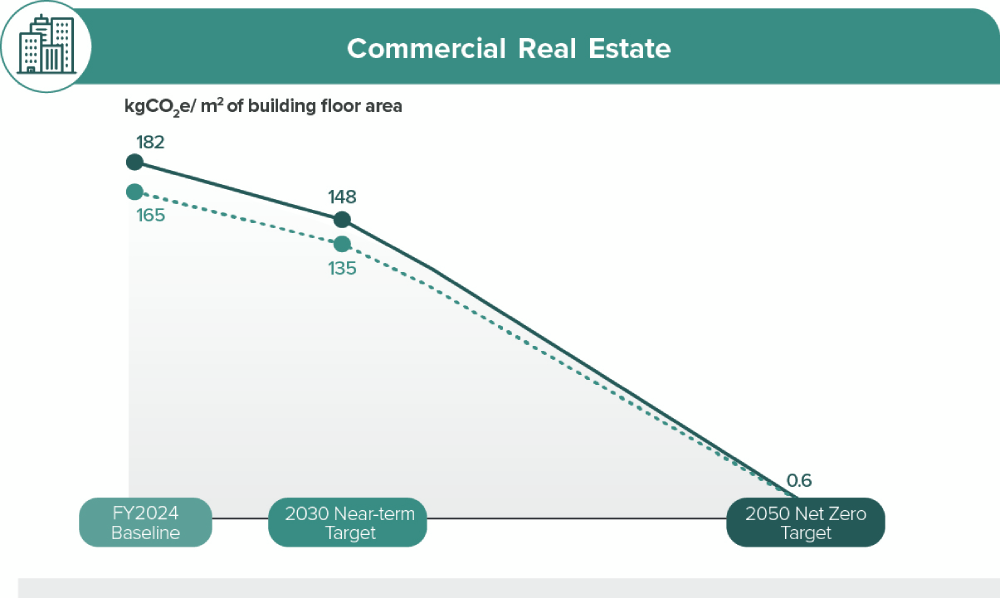

Commercial Real Estate

Position Statement on Commercial Real Estate

The real estate sector is anticipated to grow in Malaysia to support population growth, industrialisation, and expansion of data centres and the digital economy. Buildings are responsible for a significant portion of GHG emissions and have interrelationships and dependencies with other sectors. Currently, two-thirds of Malaysia’s existing old commercial and residential buildings, are expected to remain in use until 2050. Refurbishment and modernisation of these buildings are of utmost importance as they no longer meet the current building codes, energy efficiency, and safety regulations. For the successful reduction of GHG emissions in the real estate sector, the decarbonisation of the national energy grid is essential, which also involves energy efficiency initiatives and deployment of renewable energy.

AmBank Group believes that the commercial real estate sector presents opportunities to reduce carbon emissions through greener construction and energy-efficient retrofitting, contributing to a more energy-efficient real estate building. In support of this transition, AmBank Group is committed to prioritise financing for customers with sustainable real estate practices. We will work closely with customers to provide financing for green and/ or more energy-efficient buildings and finance retrofitting projects. The Group will encourage customers to strive to meet minimum sustainability ratings of applicable national standards or guidelines for the construction of property or infrastructure. We also will regularly engage with customers to better understand their near-term targets and track progress of their transition to lower-carbon business models.

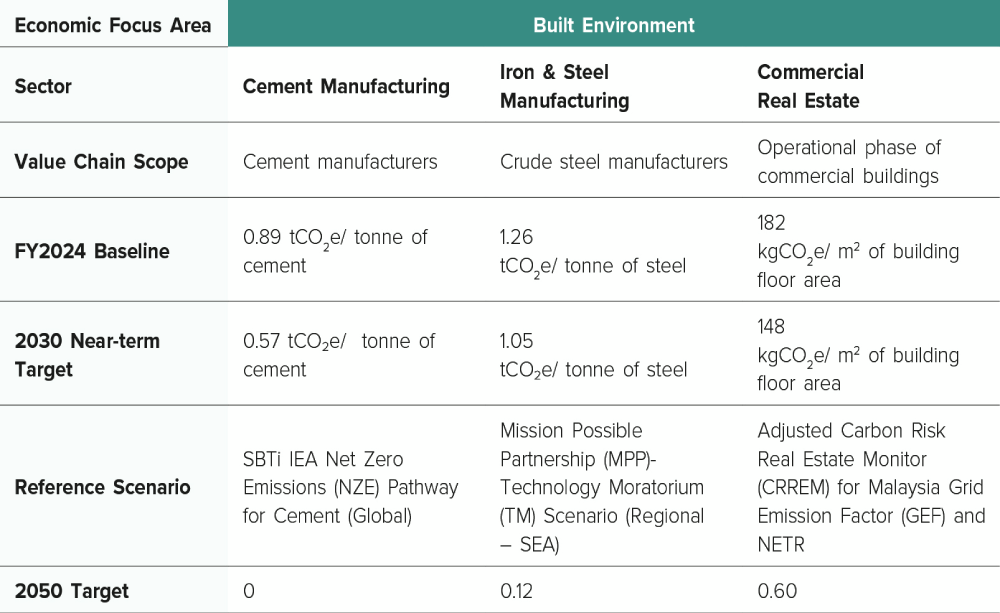

Our Sectoral Pathway and Target